Trying to teach personal finance for teens is one of the hardest things you’ll ever teach in your homeschool. But it’s also one of the most important lessons they’ll ever learn.

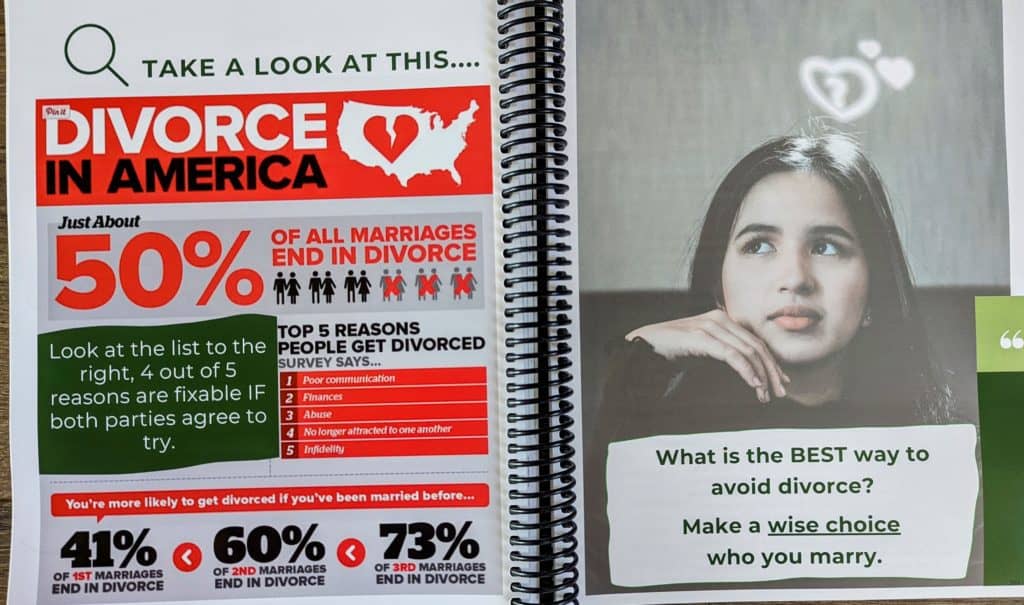

Over the years, thousands of students have been allowed to graduate high school with no knowledge of how to manage their money. This has led to excessive spending, divorce and depression. Knowing how to manage money is a skill that will not only take you far in life, but will also help you have successful relationships, too.

After all, no one likes it when you’re constantly borrowing money that you can’t afford to pay back!

Personal Finance for Teens

Put them in charge:

Allowing your teen to be in charge of their own money is a great way to help them understand just exactly how easy it is to blow through their cash fast.

I highly recommend starting out using only cash, instead of debit cards. This allows them to physically see their money dwindling away. It’s a great visual reminder that you only have “this much” money and you can’t spend more than you have.

After they’ve gotten the hang of it, set them up with their own debit card and bank account. Be sure to go over each monthly statement with them. This is an important habit that helps them realize the money is still leaving their account, even if they can’t actually see it, like they do with cash.

Teach them to save:

The hard truth is, if you don’t save when you’re poor, you won’t save when you’re rich. Although your kiddo may only be working with a $50 monthly allowance, it’s important to ingrain the habit of saving at least 10% of their money.

Don’t just force the habit: talk about it! Discuss things they can save up for. Talk about emergency situations where they might need a savings. Explain the importance of a “rainy day” fund.

Give them practice:

Sure, you can talk all day long to your kids about how expensive “real life” is, but until they’re forced to buy their own toilet paper and gallon of milk, it simply won’t register.

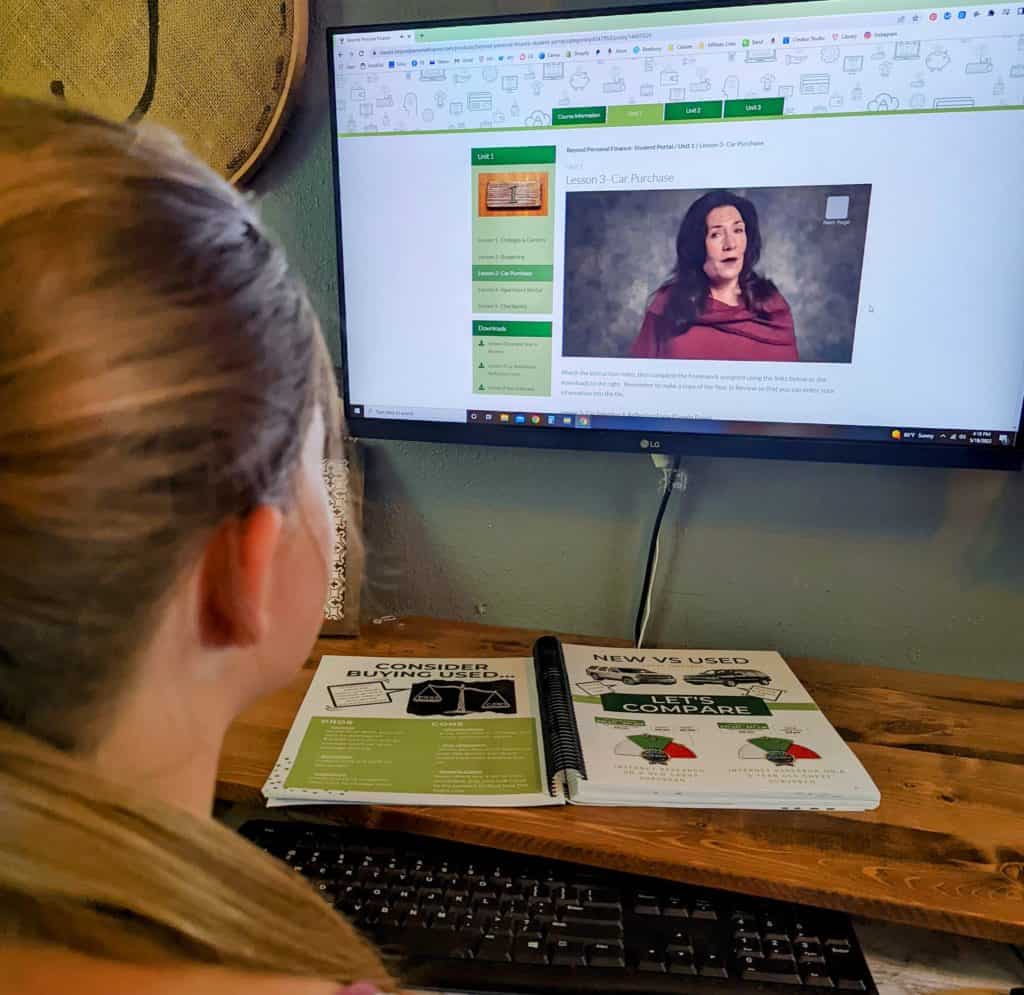

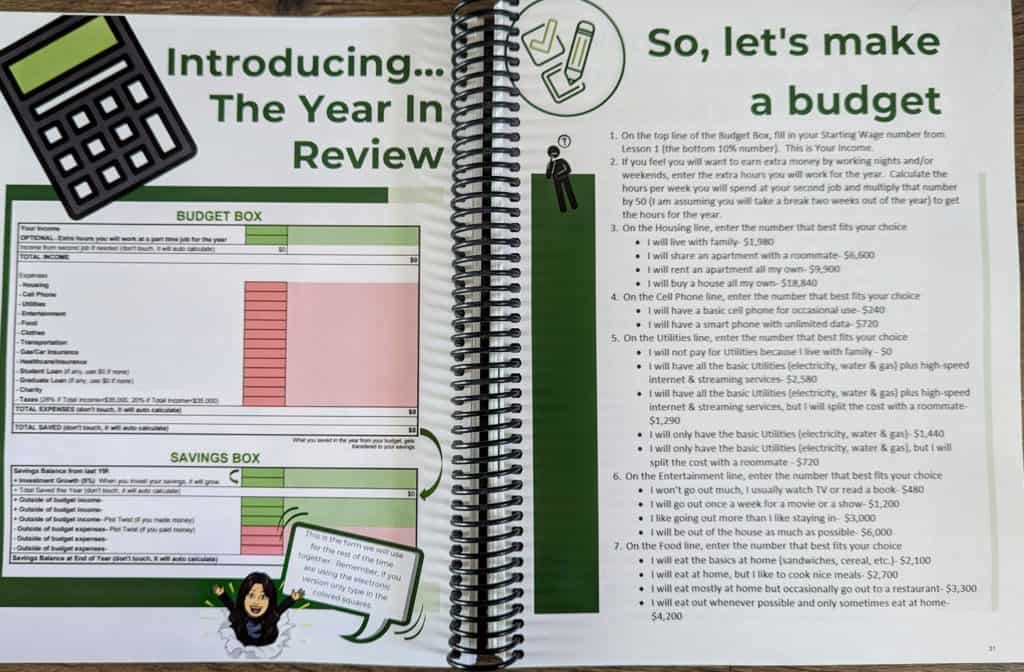

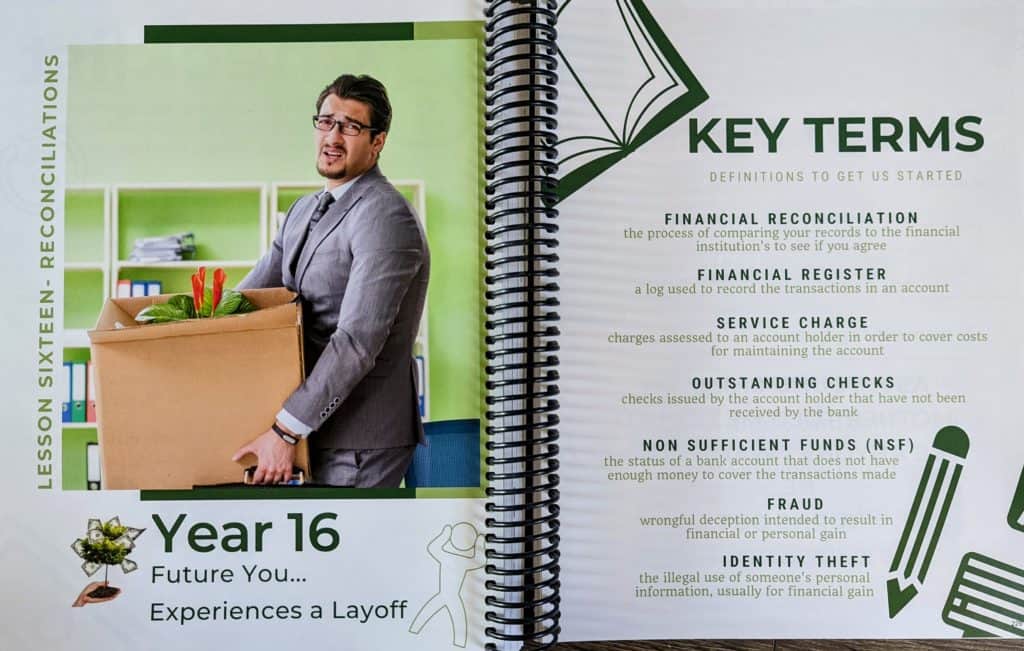

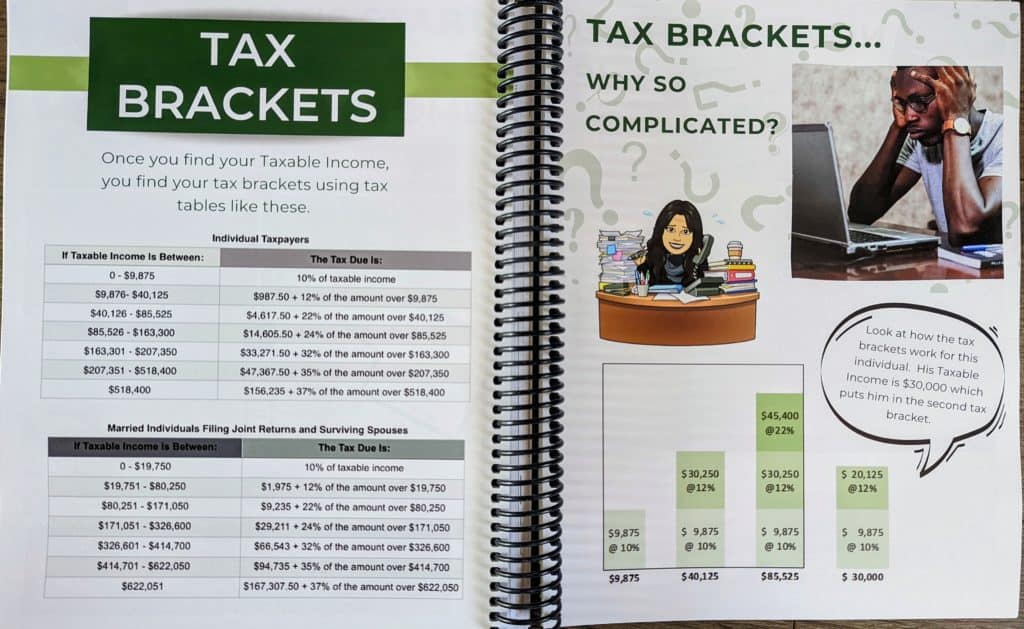

If you’re looking for a simple and fun way to teach personal finance for teens, Beyond Personal Finance is just what you need! The interactive one-semester class lets teens simulate age 22-42 by making real choices and real budgets.

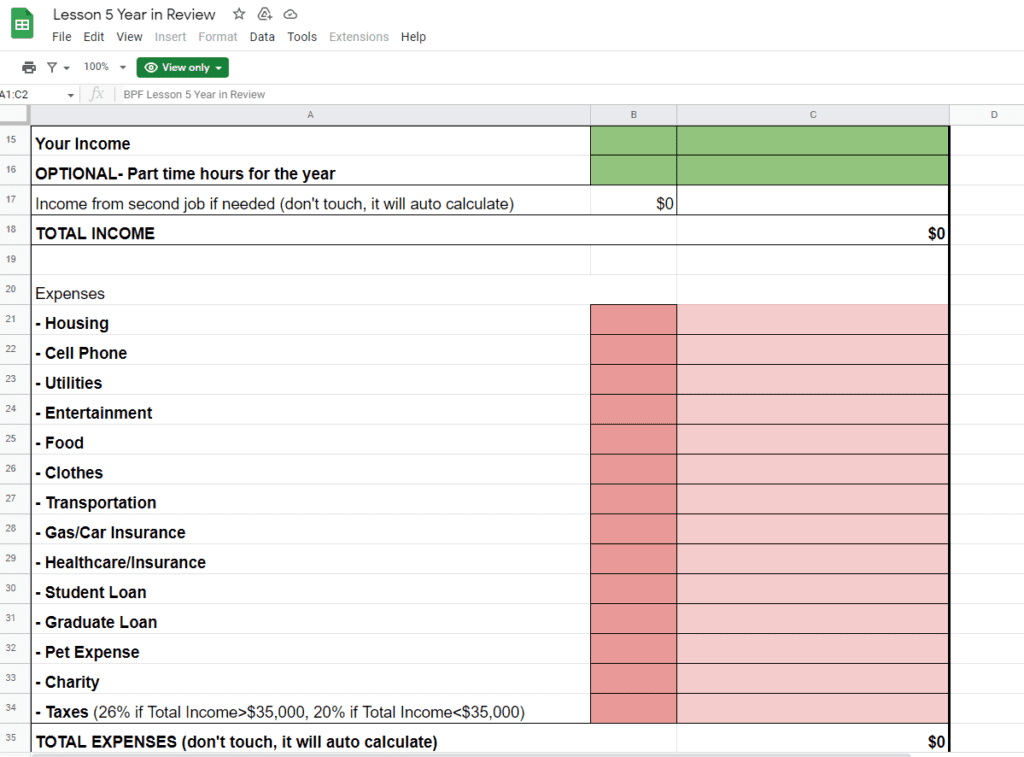

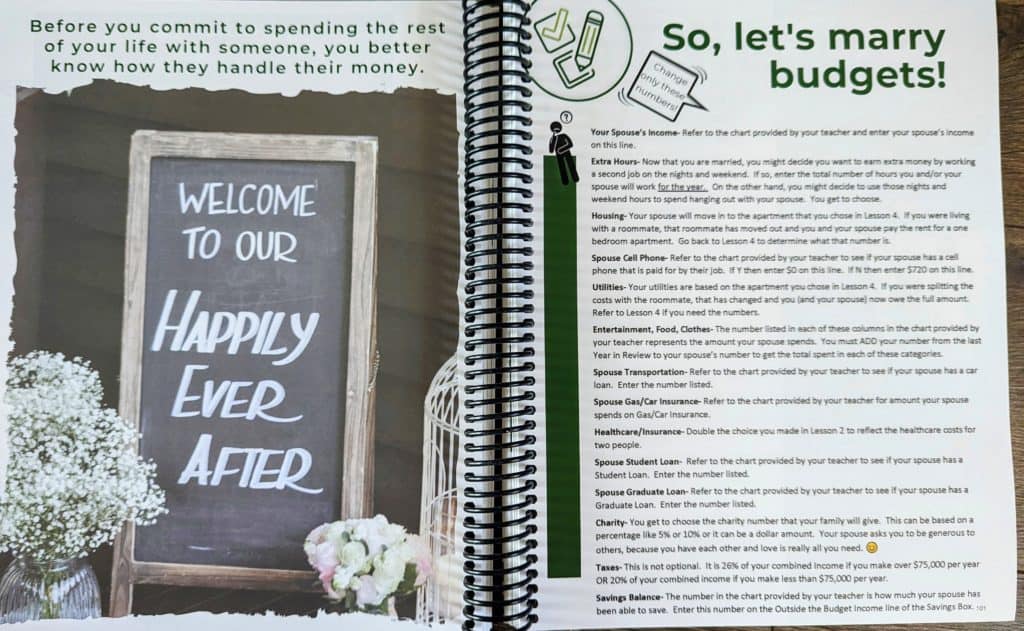

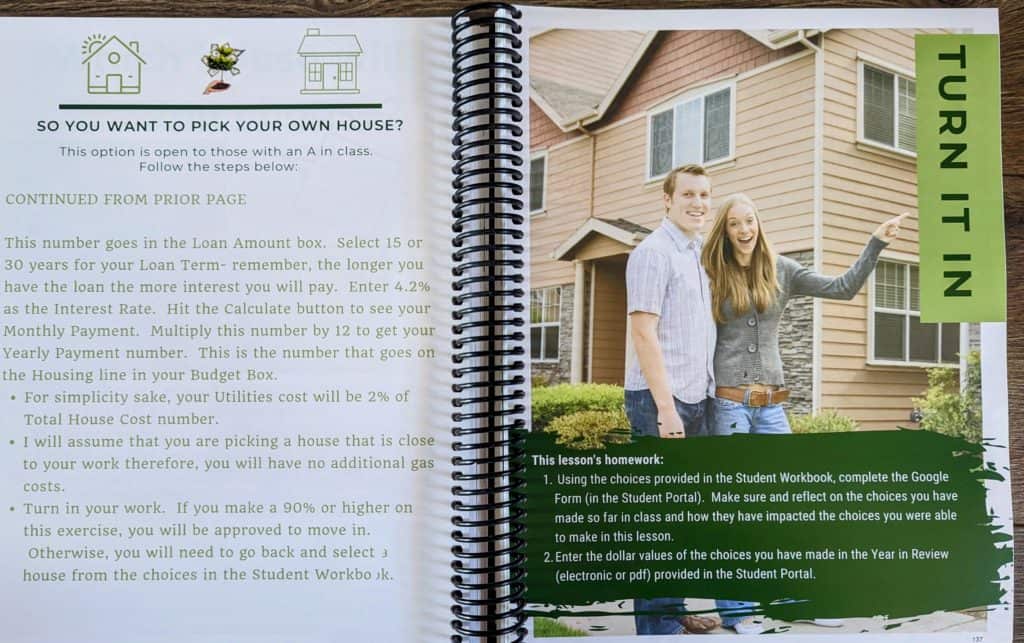

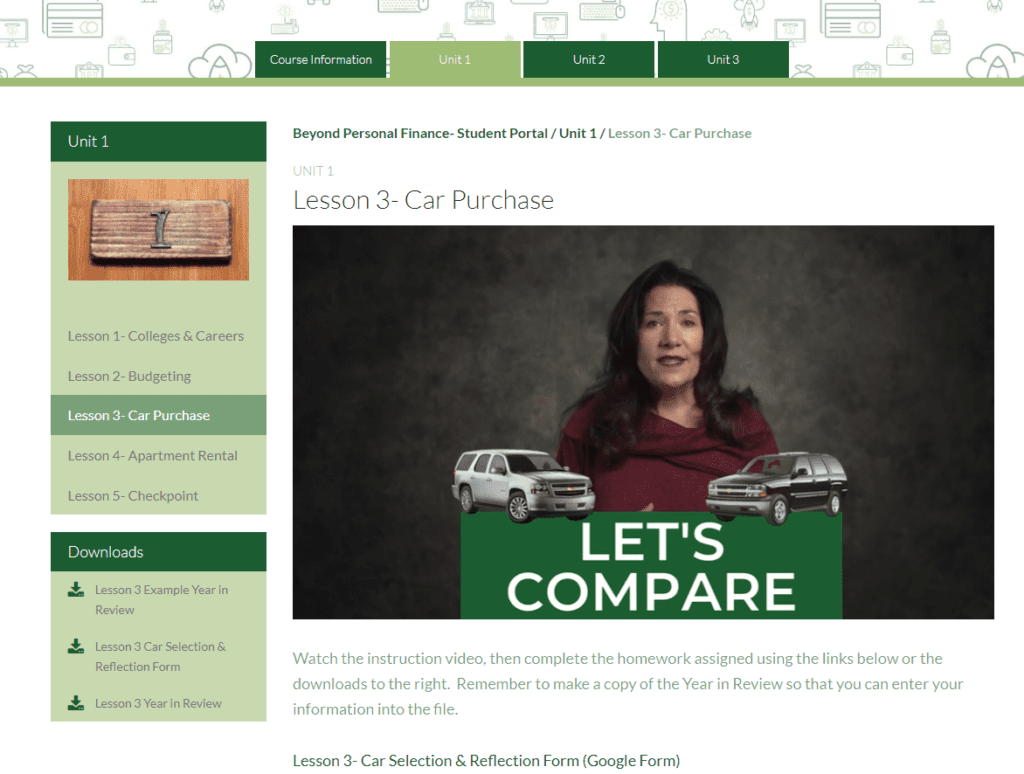

Over the course of 3 units (20 lessons) they’ll make HUGE decisions, like choosing a career, buying a house, going to college, purchasing a car, getting married and how many kids they should have. But they’ll also make smaller decisions, like whether or not they can afford a pet and the pet deposit that comes with it.

Students must step into the shoes of their “future-self” and decide what expenses can fit within their budget. This is such a fun way to learn about personal finance for teens. Instead of reading boring textbooks, they’ll have a great time with this interactive curriculum.

The class is different because it does not lecture teens about making wise choices, it allows them to experience it on their own.

Once students choose their career, they can earn money for things like sign-on bonuses or raises. Students can use this money to improve their lives or they can simply save it.

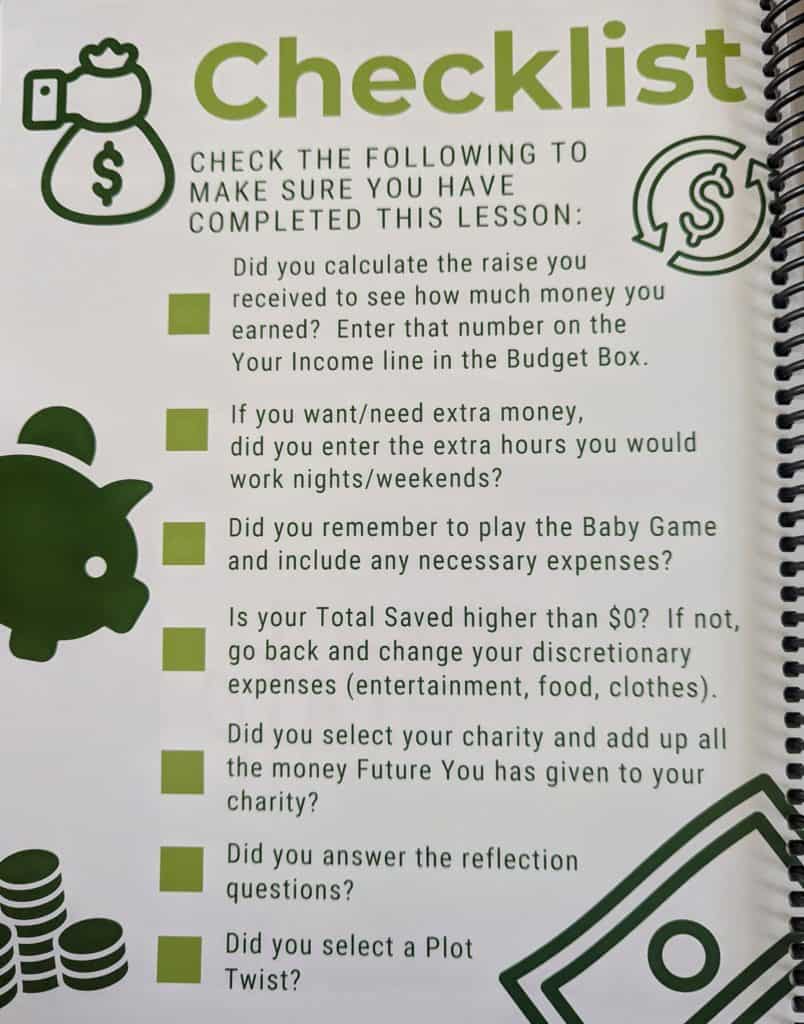

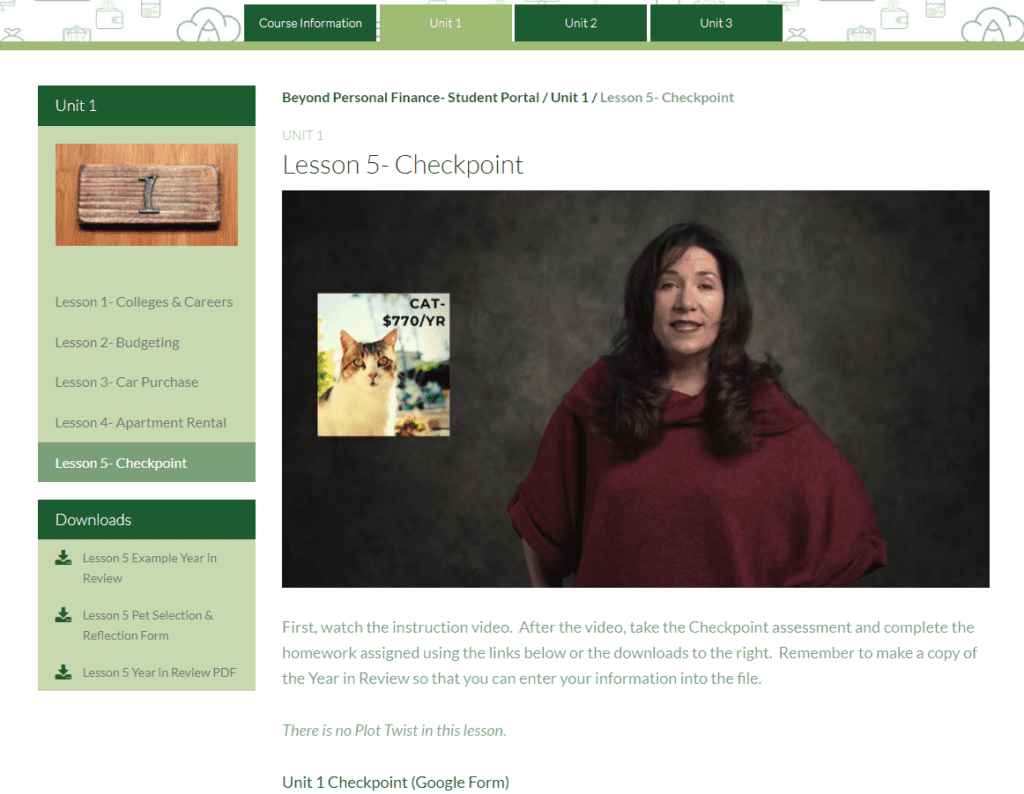

Each lesson is followed by a “Checkpoint” or review. Students will use self-grading Google forms and sheets to show exactly what they’ve learned. They are unable to proceed until they can successfully complete the Checkpoint.

My favorite part of the whole curriculum are the “Plot Twists.” Students spin a wheel to see what unexpected expenses they’ll have to endure. There’s everything from “You need to help your sibling out” to “You and your friends got too rowdy playing video games and broke your TV.” The teens will have to decide what is actually important and what expenses can wait for another day.

More about Beyond Personal Finance:

Beyond Personal Finance offers student and teacher portals that make this low-prep curriculum perfect for busy families! Parents don’t need to help their teens much, as they should be able to work through it independently in about 2 hours a week.

We love that this curriculum comes with both video lesson and an accompanying student workbook.

Parents are able to preview lessons, get video-guidance for lessons, view the answer key and see the PDF version of homework assignments. They can flip through the 300-page full-color workbook to see exactly what their student is learning.

The course has many deadlines, which is a great way to get them ready for the real world. As we all know, adulthood is full of deadlines. 😉

Beyond Personal Finance leaves students feeling:

- wise

- confident

- grateful

- prepared

- trustworthy

Looking for a personal finance for teens in a group setting?

Beyond Personal Finance offers a self-paced curriculum for your group settings! This would be perfect for co-ops or church youth groups.