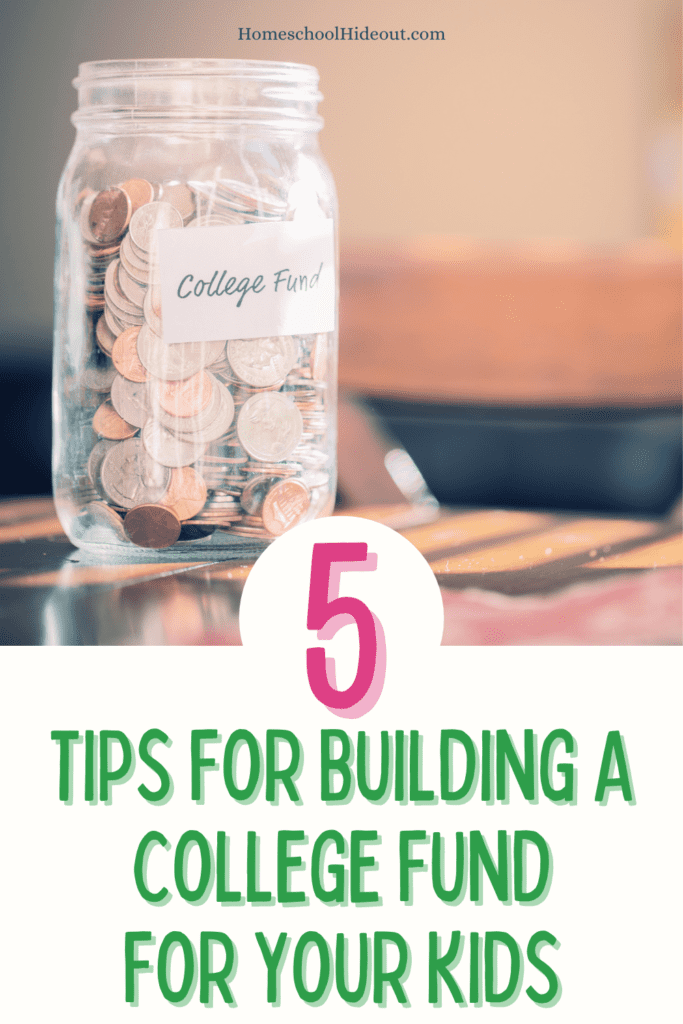

Do you have young kids who are many years away from attending college? As a parent, it can sometimes be hard to imagine far into the future. But the fact is that time flies by and before you know it your child will be applying to various schools. With that said, it’s important to have a plan in place on how you can build a college fund for your kids.

Here’s a look at five tips that you can start using immediately. Using these tips and paying for college won’t become stressful years from now.

5 Tips for Building a College Fund for Your Kids

Start a Savings Account

One of the simplest things you can do right now is open up a savings account. Then just start to make deposits. Don’t worry if you can’t afford to put a lot away, as over the years it may change. Just save what you can and allow the interest to accumulate.

You may want to check out the 529 plan, which tends to be tax-friendly and sponsored by the state government. Each state has their own rules and regulations regarding these plans, so be sure to do some research first. There are other types of educational savings accounts too, so this isn’t your only option.

Just make sure that whatever you choose, it’s easy to make deposits but difficult, if not impossible to make withdrawals until the college fund is needed.

Permanent Life Insurance Policies Can Act as Savings

Another route to take is to purchase a permanent life insurance policy. People will often use that plan to fund college. The way these policies work is that some of the money is meant for a death benefit while the rest will sit in a tax-deferred savings account. This option isn’t usually as popular, but it can be perfect for some families.

Consider Investing in Stocks

You may also want to consider investing in stocks as a way to build your savings fund for the future. If you’re new to stocks you may want to do your research first. You need to learn about what’s involved in investing in stocks, the common lingo, how to read the stock charts and so forth. Some are much riskier than others to invest in, which you’ll also want to take into account.

Because there is no guarantee when investing in stocks, be sure that you only invest what you are comfortable losing. Ideally, you make wise investments, and by the time your child is ready for college, they will have grown substantially.

Find a Way to Make Supplemental Income

Sometimes the problem isn’t where you put the money and the type of account you choose, rather it is coming up with the extra money to invest in savings. If that sounds familiar then you may want to consider a part-time job or freelance work to make a supplemental income. It may only be needed temporarily as a way to jumpstart the savings. Because it is a supplemental income, it means your overall budget doesn’t take a hit and you don’t have to worry about cutting back elsewhere.

Try Cutting Back on Expenses

Speaking of cutting back, there’s no question that this can help you free up some cash that you can then invest in savings. While there may not seem like a lot of areas you can save money, once you start looking closely at your variable expenses each month, you’d be surprised at how many options exist.

By thinking and planning for your child’s future you will be ensuring that when the time comes that they go off to college, paying for it won’t be a problem.